Once you finish creating your security questions and log-in info, you’ll be given a CRA security code. At this stage, you have limited access to your tax information. It’s important to make your security questions difficult for anyone other than yourself, as CRA accounts have fallen victim to data breaches in the past. On that webpage, you can create a username and password to log in with, as well as security questions and answers to protect your account. You will need to input the above information when you register for a CRA My Account.

Before you can register, you’ll need to have the following information: The My Account option for individuals can be created through the Canada Revenue Agency’s website.

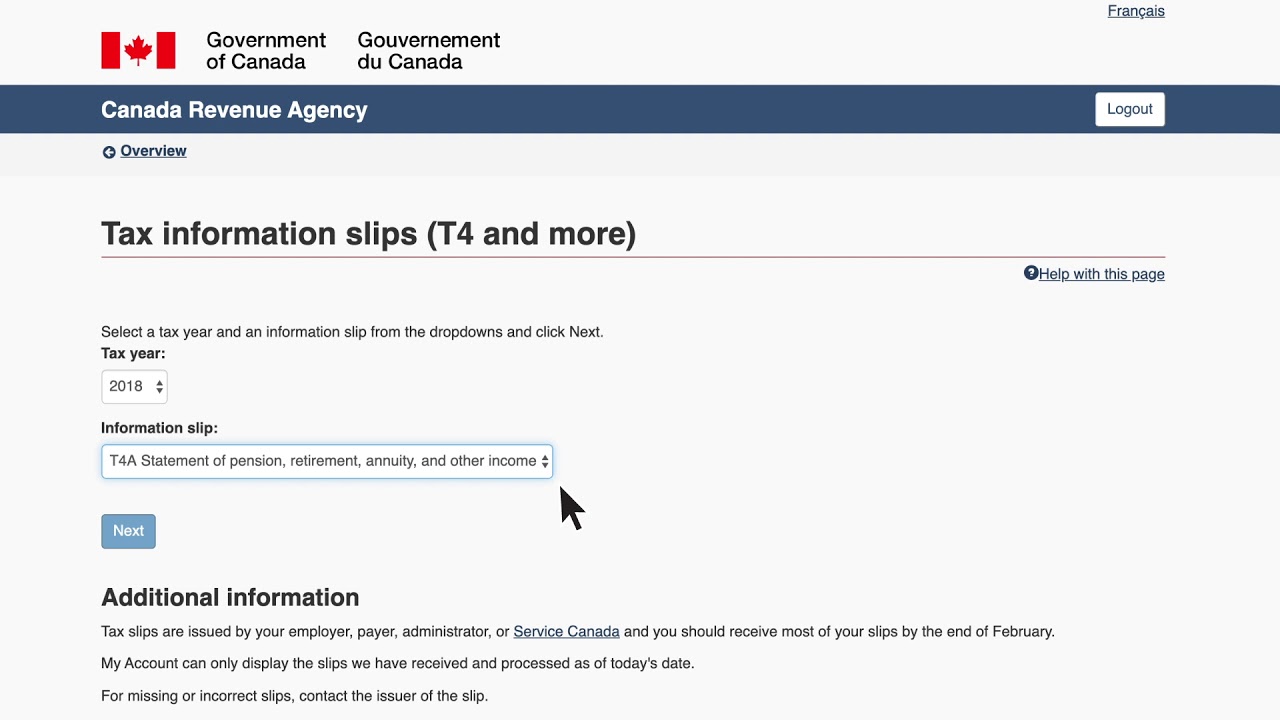

My Account allows you to handle your tax tasks completely online. Method 1 – My Account for IndividualsĪ secure portal, My Account is for individuals that wish to view their personal income tax and benefit information. The second option is to access sign-in services through a CRA partner, most often a financial institution, like a bank.

First, you can create a “My Account for Individuals, and sign up through the CRA’s website. There are two ways to open a CRA My Account. Having the ability to view all of your tax information in one place is more convenient, as it allows you to plan and prepare for tax debts and payments and can help you stay on top of your taxes and financial health. CRA My Account is a secure platform created by the Canada Revenue Agency that allows you to access your personal and business income tax information in a safe manner.

0 kommentar(er)

0 kommentar(er)